Adobe Acrobat

What is a real estate purchase agreement and how do you write one?

Whether you’re a home buyer, a home seller, or just looking to make a move on some personal property, explore what goes into making a purchase agreement and find out what to include in yours.

What is a purchase agreement?

Whether it’s called a purchase agreement, a sales contract, or a purchase contract, the purchase and sales agreement is a binding contract for the sale of goods between a buyer and a seller. You could have a purchase agreement for anything — even that old clunker you still haven’t donated to public radio — but they’re typically used for things worth more than $500. (Anything worth less than that can usually be handled with a bill of sale, or even a simple receipt.)

What’s the difference between a purchase agreement and a bill of sale?

The difference between the two might not be that obvious. Both are legal documents between a buyer and a seller in a financial transaction involving the sale of goods. In fact, both seem to use lots of the same language and may contain many of the same terms and conditions. But the purpose of each document — and its timing within the transaction — is actually very different.

A purchase agreement is a binding contract that outlines the various conditions everyone must abide by or complete in order to finalize a prospective future sale. The contract spells out the terms on which the buyer agrees to purchase the goods and the seller agrees to sell them. These agreements are most often used for real estate transactions (including real property transfers) and business assets.

A bill of sale, on the other hand, is more like a receipt than a purchase agreement. It’s a legal document, too, but it certifies a sale that has already happened and formally transfers ownership (title) of that item to the buyer. It’s most often used to transfer personal property, typically items of value like motor vehicles, boats, or planes.

What is a real estate purchase agreement?

You may also see the real estate purchase agreement called a real estate sales contract, a real estate purchase contract, or a home purchase agreement. Like any other purchase agreement, it’s a binding contract that obligates the buyer to buy — and the seller to sell — the specified item, and it describes the terms and conditions that will govern the sale.

Again like any purchase agreement, it contains information about the buyer and the seller, including names and contact information; a description of the item to be sold; the purchase price; the terms of how and when payment will be made, including any deposit or down payment amounts; the terms of how and when the item will be delivered; the effective date of the sale; and signatures by both parties.

Beyond those basics, though, there’s a world of complexity in store when you enter the realm of real estate transactions.

What goes into a real estate purchase agreement?

Real estate purchase contracts must also include this additional information:

- Full legal description of the property

- Purchase price

- Earnest money deposit amount (escrow)

- Buyer financing details

- Who is responsible for which closing costs

- Home inspection results

- Fixtures or appliances conveyed with the sale

- Any repairs the seller is responsible for

- Declaration of any environmental hazards by the seller

- Contingencies (conditions that must be met for the sale to go through)

- Contingency time frames

- Any other conditions under which the contract can be terminated

- Closing and possession dates

- Offer expiration date

Most purchase agreements are contingent on which two items?

Contingency clauses are common in real estate transactions, for good reason. Purchase agreement contingencies are conditions that must be met in order for a real estate contract to become binding. These conditions help protect both the buyer and the seller from unforeseen events and provide a legal way to back out of the transaction if the conditions aren’t met.

Numerous types of contingencies can be included in a contract by either the buyer or the seller. The four major ones are:

- Financing contingency: The offer is contingent on the buyer securing financing for the property.

- Inspection contingency: The buyer must be satisfied with the results of the home inspection.

- Appraisal contingency: The home must appraise at a value equal to or higher than the price the buyer has agreed to pay.

- Home sale contingency: The purchase is contingent on the buyer's ability to sell their current home.

Failure to meet any one of these conditions can derail a potential sale, but the two contingencies that usually have the most impact on a successful closing are a satisfactory home inspection and — most important — the buyer’s ability to put their financing package together.

For most buyers, this will be a mortgage loan. Even if you've been preapproved for a loan, the purchase agreement should be contingent on your lender's final approval. Including this contingency protects you from potential legal consequences (including loss of your earnest money deposit) if the deal doesn’t close.

How do you write a real estate purchase agreement?

The buyer's agent usually writes up the purchase contract in a real estate transaction. In theory, the buyer or seller could do it themselves — preferably with the advice of a qualified professional. You can create a contract from a standardized template or you can customize the entire agreement from scratch based on your back-and-forth negotiations, just so all the required elements are there.

Purchase agreements must be extremely clear as they specifically outline the conditions everybody must meet in order to complete the transaction. If other terms or conditions are negotiated after the agreement has already been signed, an addendum can be added, but both sides will need to sign again.

And remember that this is a contract. Make sure you know what you’re agreeing to before writing — or signing — any binding document. It’s always a good idea to get a final review from a legal professional before you commit.

Keep in mind: the only exit ramp from here on out is marked “breach of contract.”

What happens after you sign a purchase agreement?

Real estate transactions are way more complicated than buying or selling practically anything else. You may have spent years finding that dream home. Now you’ve drawn up the purchase agreement and your offer has been accepted. That doesn’t mean you’re about to get the keys.

It may take weeks or even months from contract acceptance to actually finalize the transaction. During that time, you, the seller, and various third parties all need to work together to inspect the property, verify its title, and go through the final hoops on financing in order to close the sale.

Escrow.

Once the purchase agreement has been signed and the earnest money has been deposited, you are officially “under contract.” You now have the legal right to purchase the property (assuming that all of the contract conditions are satisfied). Signing the purchase agreement and depositing the earnest money is often referred to as moving the sale into escrow.

The seller may have their own contingencies in the purchase agreement. If so, those conditions carry equal weight. If any of them remain unsatisfied, the seller can legally dissolve the contract just like you can. Both parties must agree that all of the contingencies have been satisfied; if not, the contract can be canceled.

Title search.

In most states, once the contract is signed the earnest money check is deposited with a third party such as an attorney or a title and escrow company. They research the ownership history, or title, of the property by looking through public records. The title search confirms that the seller has the legal right to sell the property and that there are no liens (legal claims) against it.

Inspection and renegotiations.

Soon after the contract is signed, you have the right to inspect the property to make sure that all is well. If the property is in good condition, continue with the transaction. If not, you may want to attempt to renegotiate the price or get the seller to make needed repairs.

Financing.

Even if you had a mortgage preapproval before putting the property under contract, there is additional work to do now that both parties have agreed on price and terms. The lender hires an appraiser to inspect and report on the property's value while they process your application for final loan approval. If everything works out, the transaction can move into the final steps.

Final inspection.

Usually, the buyer has the right to re-inspect the property right before closing. You may not be able to do a complete inspection, but you want to ensure that nothing has changed at the property. Use this inspection, called a final walk-through, to confirm that the seller has completed any repairs agreed to under the contract.

Money transfer.

Before the property is set to close, put your money in place. Arrange to have your loan funds in the escrow account either the morning before an afternoon closing or the afternoon before a morning closing, in order to allow enough processing time. This is critical — the seller won't release a deed without full payment. Other closing costs may be payable now. Know ahead of time what they are and add enough money to the escrow account before the closing appointment.

Closing.

At the closing, you sign the documents that actually transfer ownership of the property, pay off the seller's mortgage, and establish your mortgage. Money also changes hands as needed to prorate property taxes and utility bills. Any final inspection reports are delivered to the lender, and any outstanding homeowner's association dues or assessments are paid. And — finally — you get your keys.

What happens when a purchase agreement expires?

There’s no legal requirement that a purchase agreement has to contain an expiration date, but most of them do. Some contracts also include a renewal clause, to provide a little breathing room in case contingencies take longer to resolve than expected.

However, sometimes a purchase agreement does expire before closing can occur, for a variety of reasons. Perhaps the lender missed the closing date, for example, compromising your financing. Once the purchase agreement expires, there is no longer a binding contract giving you the right to purchase the property. You and the seller are no longer engaged in an active contract with each other — period. Does that mean the sale is dead? Not necessarily.

The typical remedy is to try and extend the closing date. If the lender hasn’t approved your financing by the closing date, the seller might agree to push the date back to allow more time for your loan to go through — but they don’t have to. If the loan isn’t approved, the sale will then fall through completely.

Any delay in meeting the closing schedule can have serious consequences. In a worst-case scenario where those delays end up pushing the contract past its expiration, you could lose your earnest money (if you’re the buyer) or be sued (if you’re the seller).

That’s why it’s so important to build sound contingency clauses into the purchase agreement — and why the expiration date should always be clearly defined before the contract is signed.

Send or sign digital purchase orders with Adobe.

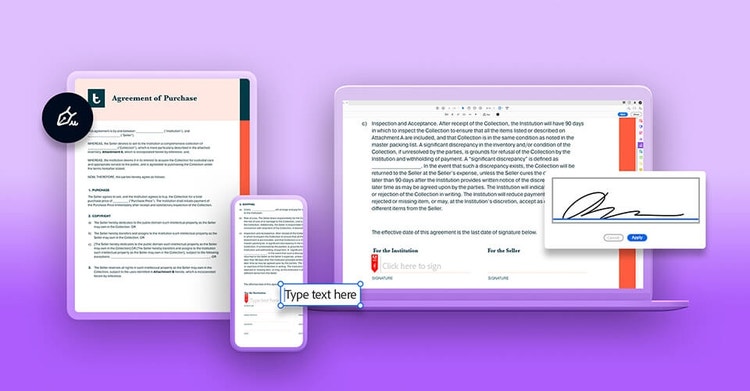

Make your mark on your purchase agreement with Adobe Acrobat Pro.

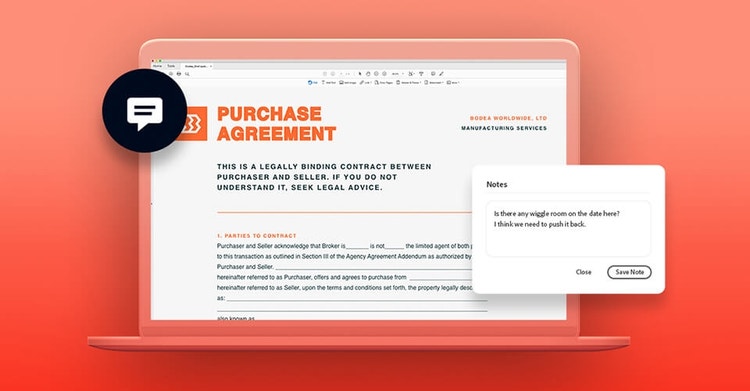

Manage your sales contract even after it’s been sent. Discover how to add a note to a transaction.

Come to an agreement.

With Adobe Acrobat Sign, you can personalize your purchase agreements, whether you’re the buyer or the seller. Create your own or use a template in Adobe Express that suits your sale. A comprehensive purchase agreement can help both parties understand what’s expected and avoid costly mistakes for complicated transactions.