Adobe Acrobat

What is a promissory note and how to write one.

No matter the loan, lender, or borrower, it’s always a good idea to put it in writing. Find out the information you need and the fastest, most reliable way to complete a loan contract.

What is a promissory note?

A promissory note is a written promise from one person or business to pay another. Also known as loan agreements or IOUs, these documents lay out the terms and conditions of a loan and ensure that the agreement is legally enforceable.

When do you need to use a promissory note?

Different types of promissory notes include business loans, student loans, car loans, and personal loans between friends and family members. You should use these written agreements when you lend or borrow large sums because they ensure that both borrowers and lenders understand the details of the loan and consequences for nonpayment. When terms of the agreement are comprehensive and the document contains all the necessary signatures, promissory notes are considered legal documents that protect both parties.

What to include in a promissory note:

- Names and addresses of both parties

- Amount of money borrowed (principal amount)

- Amount to be repaid (principal and interest)

- When and how often payments will be made (payment schedule, or “due dates”)

- Interest rate and repayment specifics

- Time frame and maturity date (date the loan will be fully repaid)

- Consequences for late payment (late fees)

- Consequences for failure to pay the full amount

- Identification and description of collateral or property securing the loan

- Statement of any rights of the lender to transfer or assign the note to someone else

- Date and place of issuance

- Signature of both lender (payee) and borrower (payer)

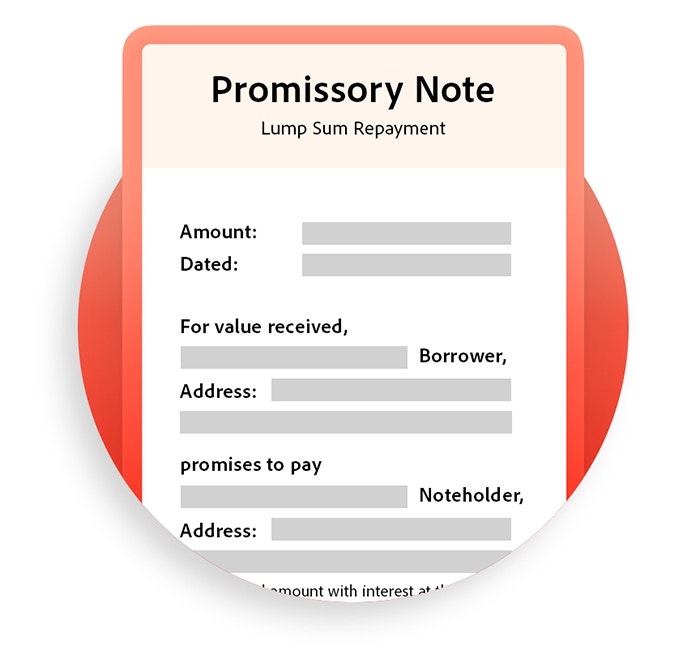

What’s an example of a promissory note?

You can find examples of promissory notes at legal resource and personal finance sites. If you don’t see one that meets your specific needs, you can cut and paste elements from several to create a custom promissory note template of your own. Use Adobe Acrobat to make a fillable and signable PDF file that you can easily share.

A concise promissory note might look something like this.

Interest and repayment.

Fixed rate loans are straightforward. The interest rate never changes, so payments are predictable.

Variable rate loans have interest rates that can decrease or increase over time. Borrowers often use these for short-term loans or loans tied to benchmark rates, which the borrower predicts will decrease.

Equal monthly payments allow for consistency and make budgeting easier for the borrower. Amortized payments are equal payments that gradually pay off the loan. At first these payments mostly cover interest, but over time they pay down the principal. An amortization schedule helps the borrower know exactly what amount of each payment goes to paying interest and what goes to paying the principal sum.

A short-term loan might include equal monthly payments or interest-only payments that end with a final balloon payment. This is a large, final payment that covers the remaining principal and interest and completes the term of the loan. These types of loans can carry greater risk for the borrower who has to pay a large lump sum on the determined date.

A promissory note might also stipulate a single payment of the principal sum and interest. The borrower makes no payments until the end of the loan term. At that time, the entire amount of the loan and interest is due.

Quick tips for lenders.

Check the borrower’s credit first. Lower credit scores indicate greater risk and merit higher interest rates. Always get security, or collateral, which is property the borrower agrees to forfeit to the lender if they can’t repay the loan amount (often referred to as a “secured promissory note”). Unsecured promissory notes are riskier investments because they can lead to your having to hire a collection agency or file a costly lawsuit if the borrower defaults.

When you determine the interest rate, be sure the rate you set complies with state law. It never hurts to get legal advice to minimize risk before you decide to make the loan.

Quick tips for borrowers.

If you are the borrower, protect yourself from exorbitant rates and check your state’s usury laws. Also check to see if you must pay interest on late payments. This can increase your cost of borrowing if you don’t keep your payments current. If the note is for business purposes, make sure that the borrower is the business, not you personally. You don’t want to have to pay the debt yourself if the business can’t pay. Generally, it’s a good idea to consult a lawyer before borrowing money.

How promissory notes can be useful for your business.

For small businesses, promissory notes offer flexibility to both borrowers and lenders. For family members or business partners who’ve already built relationships and trust, you can execute a promissory note without legal or notary costs, making it cheaper to prepare than a traditional loan. Also, parties can specify exactly how and when payments will be made. In this situation, the borrower doesn’t have to give up equity or go through a costly security offering.

Promissory notes can also help businesses secure capital from interested investors who aren’t ready to fully commit to the company. Of these convertible promissory notes, there are three types: 1) the investor gets the option to convert their loan into stock or interest in the company at the end of the loan, 2) the borrower gets the option to repay the loan or grant equity in the company to the investor, or 3) the investor receives equity if the borrower defaults.

A promissory note isn’t always the best option for borrowers. Before you borrow, you should feel good about your cash flow and your ability to repay the loan. With large sums of money, you may want a more formal agreement, and that agreement might offer a better interest rate. Also, if the loan is for a business and the term of the loan is longer than nine months, the promissory note is considered a security and must be registered.

Borrowers should also be well-informed when it comes to the terms of certain types of promissory notes. For example, a demand promissory note would require the borrower to immediately pay back the loan in full whenever the lender “demands” it back, at any time after they borrow the money. This could be a risky term to agree to, depending on the borrower’s ability to repay.

Take loan agreements to the cloud with Adobe Acrobat Sign.

In a globally connected world that moves at internet speed, e-signatures have become the best way to complete contracts. E-signatures are binding in most nations, and they can be signed and shared securely almost instantly. To learn more about how e-signatures can help you streamline all of your contract processes and save time and paper, read about German company Meyle+Müller’s successful implementation of Acrobat Sign.

With Acrobat Sign, borrowers and lenders can use PDFs to e-sign documents securely. Instead of waiting days to complete a contract, you can sign it on any device, wherever you are, and get the deal done in minutes. Get notified when the other party views and signs, and have an instant copy for your records, no stamps or photocopies necessary.

Frequently asked questions about promissory notes.

Where can I find a template of a promissory note?

Many personal finance and legal reference sites offer promissory note templates in a variety of formats. If you don’t find one template that fits the bill, you can always make a template of your own in Adobe Acrobat. Whatever template you use, be sure to save it somewhere so you can use it again. Remember that it’s always a good idea to have documents of this type checked by a lawyer before using them, whether you’re using your own template or one you found online.

Can I use promissory notes for personal loans?

Yes. You should use written agreements like promissory notes when you lend or borrow money from family or friends to ensure that everyone understands the details of the loan and consequences for nonpayment. A promissory note for a personal loan ensures that the loan is seen as a business transaction that’s separate from your personal relationship.

Is a promise to pay agreement the same as a promissory note?

Yes. A promise to pay agreement is a promissory note. They both include loan details, repayment schedules, and borrower/lender information.