Adobe Acrobat

How to create a mortgage note.

Every homeowner with a home loan needs a mortgage note. Learn what goes into one and how to speed up the process.

What is a mortgage note?

A mortgage note is a legal document in which borrowers agree to terms with the lender, or mortgagee. It is legally binding. Borrowers receive a mortgage note from a lender when taking out a loan for a new purchase or refinance. In some states, borrowers and lenders will use a deed of trust instead of a mortgage. A deed of trust is a very similar document, but it includes the naming of a trustee to act as the legal owner of the property until the contract is fulfilled.

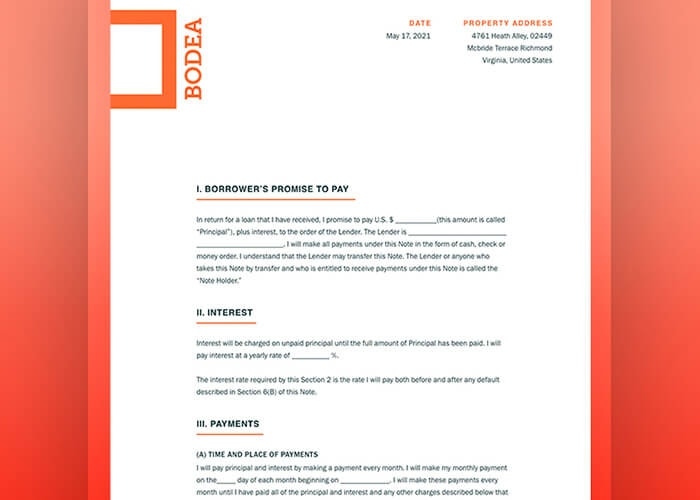

Key elements in a mortgage note.

A mortgage note usually includes:

- Amount of the loan, also known as the principal

- Interest rate for the loan

- Amount of money for the down payment

- Monthly payment amount

- Due dates for mortgage payments

- Repayment schedule for the loan and an estimated final payment date

- Any other relevant terms of the mortgage

Types of mortgage notes and why to use one.

Mortgage notes are often grouped in categories by types of property, such as residential, commercial, institutional, or private. They can also be classified by performance or payment history on the part of the borrower. Regardless of the type, every homeowner and property owner with a mortgage needs a record of how their mortgage loan is structured. This is necessary in case of dire events, such as foreclosure or if the borrower defaults, and because mortgage notes are also financial products.

Occasionally banks, real estate investors, and other note buyers will buy and sell mortgages. Mortgage notes provide a record of the stipulations and terms of the initial agreement and help prevent confusion when a new party takes on the debt. When a mortgage is sold, a borrower should receive an updated mortgage note reflecting the new state of affairs and ownership.

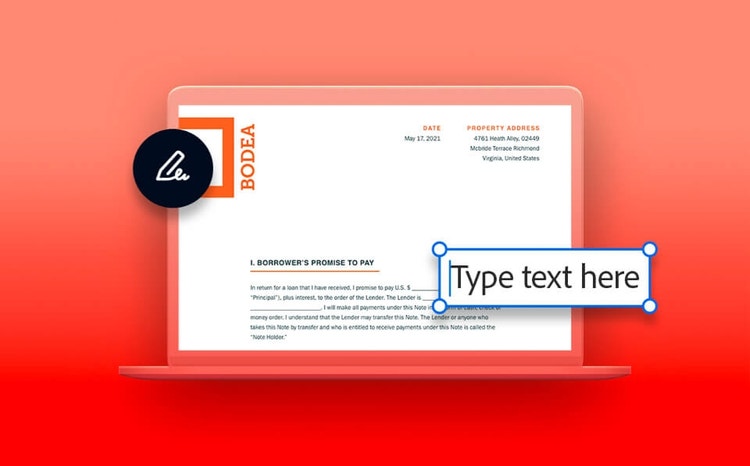

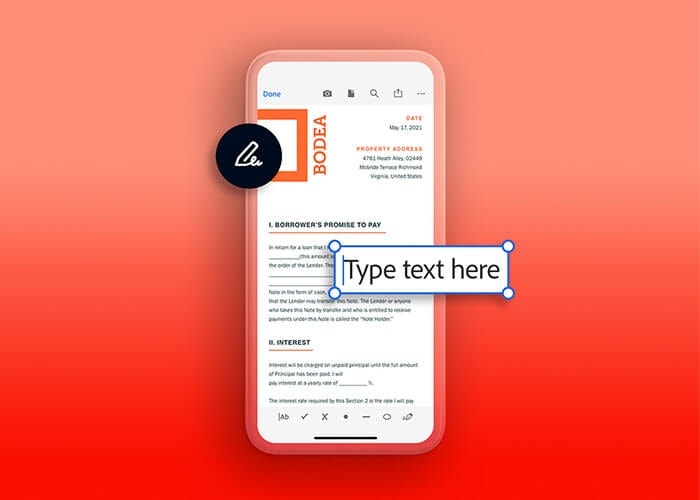

Faster mortgages with digital signatures.

Because they are legally binding, mortgage notes require signatures from borrowers acknowledging that they understand and agree to all the terms within them. E-signatures speed up the process for both borrowers and lenders. They are legal in all U.S. states and territories and in most other countries.

Skipton empowers homeowners faster with Adobe.

Founded in 1853, the Skipton Building Society has connected thousands of first-time buyers with homes. By integrating e-signatures into their approval process, the U.K. company reduced the time to save a new deal by 97 percent, connecting lenders to deals more quickly, all while cutting down on paperwork errors and providing an audit trail that satisfies local legal regulations.

Faster contracts with Sony Bank.

When Sony Bank was first established in 2001, the Tokyo-based institution often finalized contracts and loans in weeks. After digitizing their workflow and introducing e-signatures into their loan-processing system, contracts and documents that once took weeks could be processed in as little as an hour, benefiting borrowers and lenders alike.

Make mortgage notes easier with Adobe Acrobat Pro with e-sign.

A mortgage is one of the most important documents in a home buyer’s life. Buying a single-family home is the largest financial transaction that most people will perform in their lives, and it’s essential that the information about that transaction be clear, easy for the borrower to access, and compliant with all relevant laws and regulations. Adobe Acrobat Pro with e-sign makes it easy to sign mortgage notes and other relevant documents. E-sign everything from prepayments to promissory notes safely and quickly with technology that cuts down on paperwork and gets the job done faster.