Adobe Acrobat Sign

Keep lending terms clear with a loan agreement.

Learn about business and personal loan agreements. Then create your digital documents to outline the details of loan repayments.

What is a loan agreement?

A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the repayment terms, and what happens if the borrower defaults (is unable to pay according to the terms). Loan agreements should be used even when lending money to a friend or family member. Unlike a casual IOU, a formal contract makes every detail clear for both parties, can be legally binding, and can help prevent disputes.

How is a promissory note different from a loan agreement?

Loan agreements and promissory notes are very similar types of contracts. They both provide details about a debt that a borrower promises to repay. However, a loan agreement likely contains longer and more detailed clauses and is signed by both the borrower and the lender, while promissory notes are sometimes only signed by the borrower.

What to include in your loan agreement?

A loan agreement lets you set expectations with the other party to leave nothing up for interpretation. It serves as legal proof that money was borrowed, there was a plan for returning it, and what should happen if the plan isn’t followed. If you’re a lender, agreements give you leverage should you need to take action against nonpayment. And if you’re a borrower, they assure that, by law, you won’t be required to pay back more than the agreed-upon amount.

Common items in personal loan agreements.

Include key terms of the loan, such as the lender and borrower’s contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can’t make the payments, and more.

- The amount of the loan, also known as the principal amount.

- The date of the creation of the loan agreement.

- The name, address, and contact information of the borrower.

- The name, address, and contact information of the lender.

- A plan for loan payment, such as a monthly payment plan with start dates and due dates.

- The maturity date or the date that the final payment is due on the loan.

- The interest rate of the loan and how payments will be applied to it.

- Prepayment details specifying if and how the borrower may make additional payments or pay back the loan in one lump sum.

- Consequences if the borrower fails to make payments or in the event of default. You may also include penalties such as late fees for late payments.

- Details about guarantors who promise to repay the loan should the borrower fail to pay or successors who will be responsible for the loan in the case that the borrower passes away.

- An “in witness whereof” section for signatures and dates of signatures from the borrower, the lender, and one or two witnesses.

More detailed clauses you may find in business or bank loans.

More complex loans, like mortgage notes, may include additional clauses to outline items like interest rate fluctuation or assets being put up as security.

- Fluctuation of interest clause: Gives banks permission to change interest rates based on base-rate fluctuations.

- Force majeure clause: Gives the lender permission to alter interest rates based on extraordinary economic circumstances.

- Security cover clause: For secured loans, outlines assets that are being offered as security for the loan amount. For home loans, the security is the property being bought.

- Default definition clause: Defines what qualifies the loan as being in default. Often, this means the borrower has missed a certain number of payments.

- Disbursement clause: Makes it clear exactly where the borrowed money will be sent.

- Reset clause: Defines if and when interest rates will be revisited and reset.

- Other balances set-off clause: Outlines how payments will be offset by other balances owed between the parties.

- Third-party repayment collection clause: Claims the right of the lender to hire third parties to help in the collection of payments.

- Amendment clause: Gives the lender the right to amend any clause without informing the borrower (a cause for particular caution on the part of the borrower).

- Notification clause: Specifies certain life changes that the borrower must inform the lender about, such as a change in income or residential address.

- Severability clause: Proclaims that should one provision of the agreement be deemed void or unenforceable, it will not affect the validity of the other provisions of the loan.

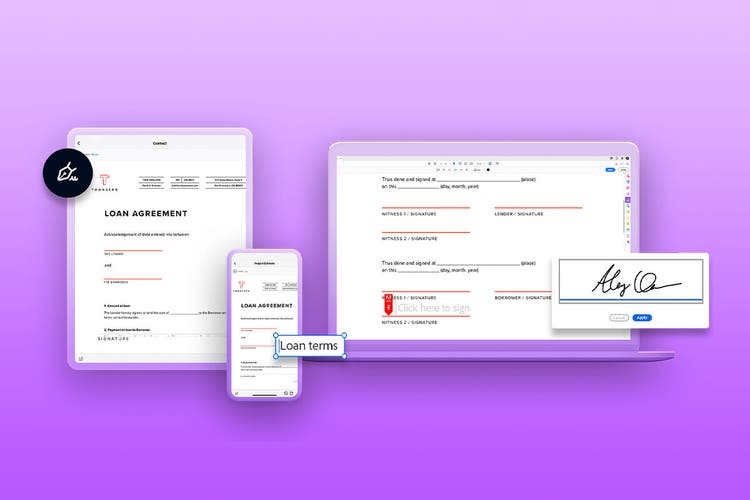

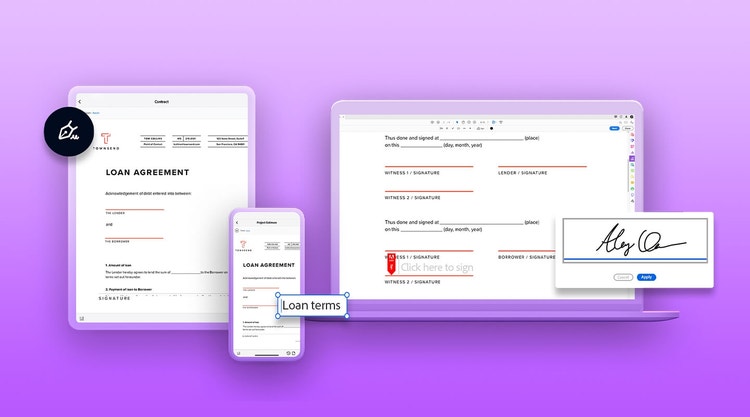

Create, send out, or e-sign loan agreements digitally.

E-signatures are legally binding. And going digital makes it easier than ever to create and sign legal documents like loan agreements. That’s why, in a 2020 Forrester Consulting study, 72 percent of respondents in financial services firms said they consider digital document processes essential to their business.

Cut costs with e-signatures.

Financial businesses are making processes easier for themselves and their borrowers by going paperless. Sony Bank is using e-signatures to dramatically reduce the time it takes them to finish mortgage loan contracts. Work that used to take them two to three weeks now takes as little as one hour, and they’ve cut operational costs by 10 percent.

Make digital signing a part of your loan agreement process.

With Acrobat Pro, getting necessary loan contracts signed is smooth sailing. Of course, always get legal advice before creating or signing a loan agreement. And, as a borrower, be sure to read the entire agreement with your legal counsel before signing.